Rhode Island: $250 Rebate Per Child

Rhode Island is sending a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children, for a maximum of $750. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate check distribution began in October. Taxpayers who filed their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December. You can check your rebate status on Rhode Islands Division of Taxation website.

Fourth Stimulus Check Approval: Here’s What It’ll Take

The White House hasn’t responded to any of the proposals for additional stimulus checks, and the general sentiment is that a fourth stimulus check isn’t likely. Economists have suggested we’ve already moved past the pandemic’s worst financial woes, although there are signs that Americans could still use relief.

Experts certainly seem in agreement that there won’t be a fourth stimulus check. The latest stimulus package, the American Rescue Plan, is “gonna be the last on that front,” Deutsche Bank senior U.S. economist Brett Ryan told Fortune . “No more checks.”

Ed Mills, Washington policy analyst at Raymond James, agreed, telling CNBC recently “I think its unlikely at this time. D.C. has largely started to pivot towards the recovery and an infrastructure bill.”

Many economists and financial experts are worried that the third stimulus checks have contributed to a growing inflation rate. In June 2021, the core inflation rate, stripped of energy and food prices, rose 4.5% at an annual rate vs. the Dow Jones estimate of 3.8%. The overall consumer price index rose at an annualized 5.4% rate in June.

Worsening Economic Conditions Would Likely Be Necessary For Another Stimulus Check

It is unlikely in the current economic climate that a fourth payment would be authorized even if there is a change in the makeup of Congress. There are no widespread lockdowns right now, and because of high inflation, many lawmakers are reluctant to pump more money into the economy which could make inflation worse.

You May Like: How To Cash My Stimulus Check

Which Of My Dependents Qualify For The Third Stimulus Check

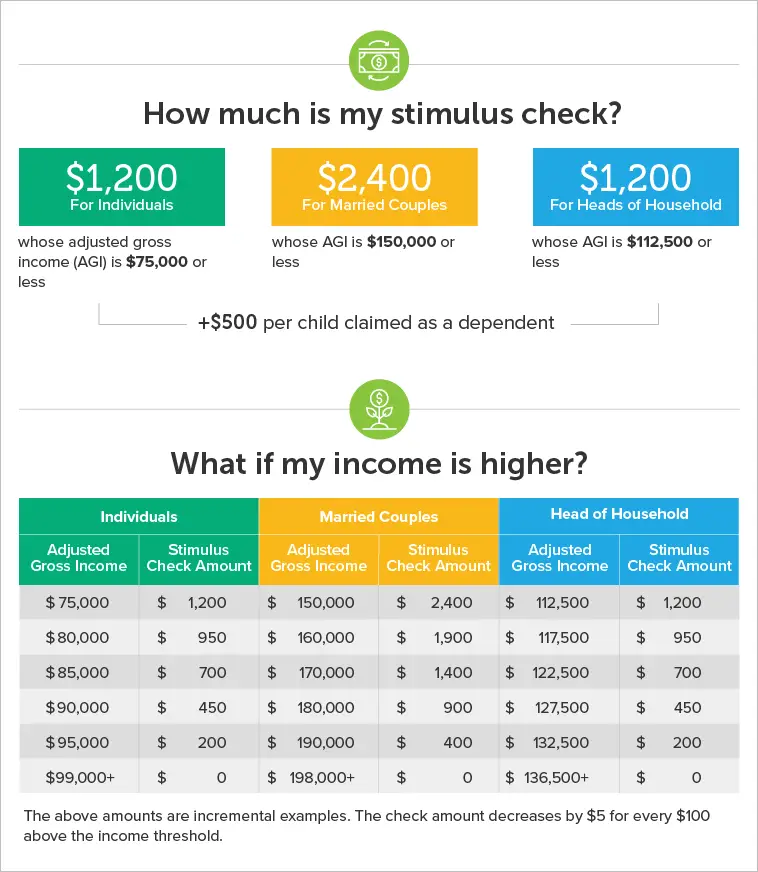

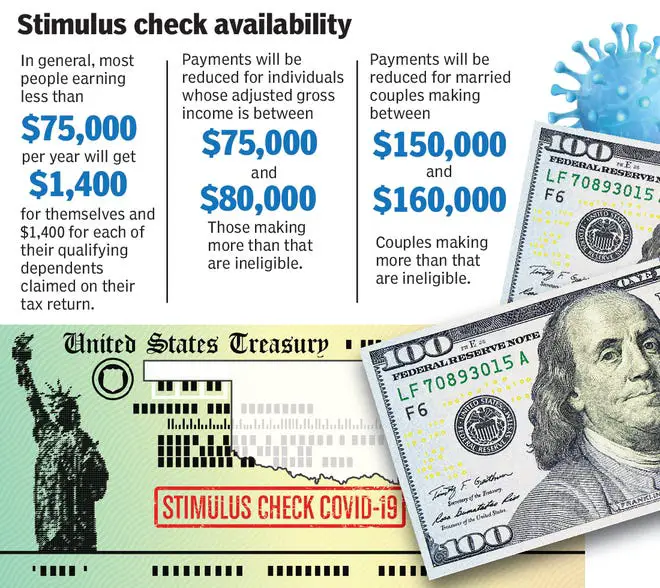

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Best Ways To Keep Up With This All

If youre having trouble keeping track of what this all means and who may be eligible, youre not alone. Continue to follow along at BGR.com but also check your own states government websites to see if youre eligible for more money. Plus, theres the aforementioned IRS portal and the U.S. Department of Treasury links for COVID-19 relief.

Also Check: Can You Claim Stimulus On 2021 Taxes

Irs Says It’s Sending Millions More Additional Stimulus Checks

The IRS on Wednesday said it is continuing to distribute federal stimulus checks to eligible Americans, with another 2.2 million payments issued as recently as July 21. Some of those payments include “plus-up” adjustments for people who received less money than they were entitled to in earlier checks.

The latest round of payments is part of the Biden administration’s efforts under the American Rescue Plan to deliver $1,400 to each eligible adult and child. The IRS said it has now delivered more than 171 million payments worth more than $400 billion, with the last batch of checks amounting to more than $4 billion.

The tax agency added that it is continuing to issue stimulus checks on a weekly basis. Payments are still going out to people for whom the IRS didn’t previously have enough information to issue a check but who recently filed a tax return, as well as for people who qualify for extra money known as “plus-up” payments.

The IRS has said it has sent more “direct relief” via the third stimulus check than compared with the two previous rounds of payments. More than half of the payments have been sent to households earning less than $50,000, while about 1 in 10 stimulus checks were sent to Social Security and other government-aid beneficiaries who aren’t required to file a tax return, and to those who used the Non-filer tool on the IRS website, the agency has said.

A Fourth Stimulus Check Is Possible

For most Americans, it is extremely unlikely a fourth stimulus check will be provided. Here are a few key reasons why:

For all of these reasons, another check is unlikely to happen unless conditions take a dramatic turn for the worse — such as another COVID-19 variant that is vaccine resistant, easily transmitted, and more deadly.

Also Check: Are We Getting Another Stimulus Checks

What If I Was Underpaid Or Overpaid

First, double-check how much money you should be getting and make sure the amount you think youre supposed to get is right. You can do this on the IRSs Child Tax Credit Eligibility Tool or by checking to see what amount is on the letter that the IRS sent to you at the beginning of July .

If it still looks a little weird to you guys, then head over to the IRS Portal and make sure they have your latest information.

How Likely Is A Fourth Stimulus Check

Don’t hold your breath, according to Wall Street analysts.

For one, the Biden administration has focused on infrastructure spending to spark economic growth, betting that an investment in roads, trains and other direct investments will help get people back to work and spur the ongoing recovery.

Secondly, economists have pointed fingers at relief efforts such as the three rounds of stimulus checks for contributing to inflation. Because Americans had cash in their pockets, they boosted spending on goods such as furniture, cars and electronics. Combine that with the supply-chain crunch, and the result was sharply higher inflation, according to economists.

Without new stimulus efforts on the horizon, it’s likely that inflation could moderate in 2022, according to Brad McMillan, the chief investment officer at Commonwealth Financial Network. “One cause of inflation has been an explosion of demand driven by federal stimulus,” he noted in a December report. “But that stimulus has now ended.”

He added, “Yes, we will continue to face inflation and supply problems, but they are moderating and will keep doing so.”

Don’t Miss: Is There Any Stimulus Coming

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a Recovery Rebate Credit. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Also Check: Stimulus Check How To Qualify

If I Take The Advance Payment How Does This Affect Next Years Taxes

Good question, you guys. The biggest thing here is if your income increases in 2021, then you might get more money in the Child Tax Credit than you actually should get. Remember, guys, theyre basing the amount they think you should get on your 2020 tax return . So,if you or your spouse got a raise at work and it bumped you over the qualifying amount, the IRS doesnt know about it.

If youre super confused by all of this, youre not alone. The State of Personal Finance study found that 70% of parents who qualify for the Child Tax Credit money say theyre afraid to spend it because they dont know how it will impact their taxes next year. That totally makes sense, guysbut dont stay in the dark here. Its so important to be in the know about these changes and how they affect you.

With all these tax changes, its a good idea to call in the folks who live and breathe this stuff. If you want your taxes done the right way, check in with a RamseyTrusted tax pro. Theyre the experts who can walk you through this new Child Tax Credit change and how it impacts your money. And theyll help you make the right call on whether you should take the advance payments or leave them alone. They can also show you the best way to plan out your taxesyou know, so you dont end up with a huge scary bill or a crazy high refund. When it comes to your tax questions, leave it to the pros.

About the author

Rachel Cruze

You May Like: How Can I Check For My Stimulus Payment

Congress Previously Acted Quickly To Get Relief To Americans Affected By The Pandemic

When the US and the world were put on lockdown, millions of workers were confined to their homes sending the unemployment rate skyrocketing to 14.7 percent in April 2020. Congress acted rapidly to pass the 2020 CARES Act to get relief to businesses and households, including the first round of stimulus checks of up to $1,200 for eligible adults and $500 per qualifying kid under age 17.

Congress also passed generous enhanced pandemic unemployment benefits which kept households afloat where workers businesses were shuttered or they had to stay home because of pandemic-induced upheavals in their lives. Those benefits were extended in 2020 and again in 2021 but have now ceased, being seen by some as the reason behind a severe labor shortage in the US.

Two more rounds of stimulus checks were also passed in the interim of up to $2,000 in total. They are credited with supercharging the economic recovery which had begun to lag at the end of 2020 as a new variant caused infections to surge. But the last one has also been blamed for the current high rate of inflation.

Number of unemployed people per job opening unchanged at 0.6 in December 2021 #BLSdata

BLS-Labor Statistics

Why Are States Giving Out A Fourth Stimulus Check

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they dont have forever to spend this moneystates have to figure out what to use it on by the end of 2024, and then they have until the end of 2026 to spend all that cash.2That might sound like forever, but the clock is ticking here.

Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they havent spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a wide-sweeping stimulus check.3 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

Read Also: How To Report Stimulus Check On 2021 Tax Return Turbotax

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Is Another Check Possible Before Jan 3

Since the prospects of another payment will fade beginning in January of next year, the big question is whether any legislation will pass before then to offer necessary support to families.

There is actually a possibility this could happen. Democrats are obviously aware they will face an uphill battle on any legislation once they are no longer in control of the House of Representatives. During the next several weeks, they can vote on bills in a so-called “lame duck” session while they still have a chance to move President Joe Biden’s agenda forward.

Since expanding the Child Tax Credit has been a major goal of the Biden administration, it is possible this could happen in the coming weeks before control of Congress shifts. This would mean that parents and families do end up getting a little extra help even if not all Americans do.

If you’re hoping for more financial relief, be sure to keep a close eye on what lawmakers are doing this month since these coming weeks are the best chance of a payment heading your way.

You May Like: Will Social Security Get The Fourth Stimulus Check

When Will Social Security Recipients Ssi And Ssdi Receive Their Stimulus Check

The Social Security Administration transmitted payment information for nearly 30 million to the IRS to get stimulus checks out the door after several Congressional leaders said they were alarmed at the lack of payments.

Many non-filers who receive benefits from SSI and the Railroad Retirement Board have also not received their checks and are part of the April 7 rollout. Those beneficiaries of Veterans Affairs, however, are still going to have to wait for their checks, the IRS said.

Already about 90 million people have received their third wave of stimulus checks, according to a joint letter to the heads of the Internal Revenue Service and Social Security Administration.

You can check the status of your payment using the IRS Get My Payment Tool.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

What States Are Paying A Fourth Stimulus Check

There likely wont be another stimulus check from the federal government coming anytime soon. But a number of states have approved a fourth stimulus check for their residents welcome news amid rampant inflation. And more states could do the same in months to come. Lets break down which states are paying a fourth stimulus check and how much you could get.

For help with managing stimulus payments or with any other financial questions, consider working with a financial advisor.

Recommended Reading: Do I Have To Claim Stimulus Check On 2021 Taxes

State Stimulus Payments In 202: These States Are Still Sending Out Checks

Dozens of states announced tax rebates in 2022. Find out which are still sending payments in the new year.

It’s a new year, but numerous states are still issuing tax refunds and stimulus checks announced in 2022. Massachusetts only began returning $3 billion in surplus tax revenue to residents in November, and California officials don’t expect to finish issuing the state’s “middle-class tax refunds” until mid-January. New Jersey homeowners haven’t even started getting payments from the state’s $2 billion property tax relief program, which was signed into law by Gov. Phil Murphy last summer. Those likely won’t go out until the spring.

Your state could still be sending out checks, too. See if you qualify and how much you could be owed.

Which Federal Beneficiaries Are Included

Many federal beneficiaries who filed 2019 or 2020 returns or used the online Non-Filers tool last year were issued Economic Impact Payments, if eligible, during the past three weeks, the IRS said.

The latest update applies to Social Security, Supplemental Security Income, and Railroad Retirement Board beneficiaries who didnt file a 2019 or 2020 tax return or didnt use the Non-Filers tool.

IRS tax deadline:Retirement and health contributions extended to May 17, but estimated payments still due April 15

You May Like: Will We Get Another Stimulus Check Soon

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Stimulus Checks: See If Your State Is Mailing Out Payments In November

Stimulus payments have been one of the hallmarks of the coronavirus pandemic, with the federal governments trillions of dollars capturing the biggest headlines. But states have been doling out payments as well. While much of the stimulus has already been dispersed, a number of states are still mailing out payments in November and beyond. Heres a quick overview of state stimulus payments that are still on the way.

Don’t Miss: How To Check If I Got My 3rd Stimulus