Increase The Child Tax Credit Earned

- For those without children, the American Rescue Plan increased the Earned-Income Tax Credit from $543 to $1,502.

- For those with children, the American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and $3,600 for children under the age of six and raised the age limit from 16 to 17.

- The American Rescue Plan also increased and expanded the Child and Dependent Care Tax Credit, making more people eligible and increasing the total credit to $4,000 for one qualifying individual and $8,000 for two or more.

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who received the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check by July 31, 2022.

How To Claim Your $1400 Stimulus Check In 2022

SOME Americans can claim a $1,400 stimulus check in the new year.

However, there is specific criteria to follow to receive the cash in 2022.

The new payment will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but haven’t yet received them.

The last lot of checks are due to go out when eligible taxpayers file their 2021 tax return next year.

Read Also: Social Security Stimulus Checks 2022

Rhode Island Stimulus Checks

Rhode Island families who qualify for a child tax rebate this year will receive $250 for each child who was 18 years old or younger at the end of 2021 up to a maximum of $750 . The state started sending payments on a rolling basis in October to residents who filed their 2021 Rhode Island tax return August 31, 2022. However, for people who file an extended tax return by October 17, 2022, checks will hit mailboxes in December.

If you’re married and filed a joint Rhode Island return for the 2021 tax year, you qualify for a rebate if your federal adjusted gross income can’t exceed $200,000. For everyone else, your federal AGI must be $100,000 or less.

Check out the Rhode Island Division of Taxation’s online tool if you want to see the status of your rebate.

For Rhode Island taxes in general, see the Rhode Island State Tax Guide.

State Stimulus Payments Could Be Considered Taxable Income

When the federal government sent out stimulus checks during the COVID-19 pandemic, the checks were advances on tax credits. Since tax credits reduce your tax bill and aren’t considered income in a traditional sense, you didn’t have to worry about owing taxes on your federal stimulus checks.

But, in some cases, the states that sent out payments are reporting the distributed money as income. For example, the California Franchise Tax Board decided it would report the middle class refunds the state was sending out to the IRS if the payments were valued at over $600. The reason for this choice is that California payments were exempted from state income tax, but the money could still be considered income by the IRS.

This is not the case with all stimulus check payments sent by states. For example, the state of Colorado has indicated that the Cash Back tax refund is not considered taxable income. But it is possible other states will take a similar approach to California and require that you report your state stimulus funds to the IRS as income.

Recommended Reading: Is There Any Stimulus Check Coming

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

You May Like: Va Stimulus Checks Deposit Date 2021

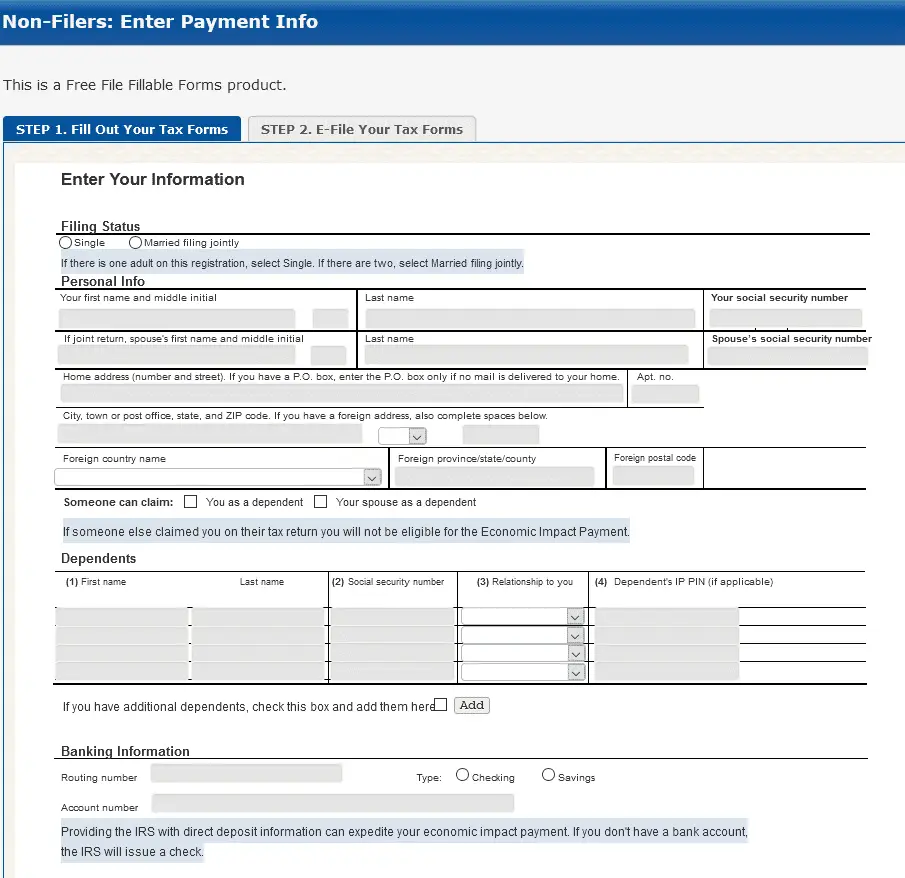

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

When You’ll Receive Your Payment

The final date to qualify has already passed for filers other than those with pending ITINs. If you have already filed, you don’t have to do anything.

If you have not received a payment by now, you will most likely receive a paper check. In addition, if you did not receive a refund with your tax return or owed money at the time of filing, you will receive a paper check.

Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Some payments may need extra time to process for accuracy and completeness. If your tax return is processed during or after the date of your scheduled ZIP code payment, allow up to 60 days after your return has processed. Please allow up to three weeks to receive the paper checks once they are mailed out.

| Last 3 digits of ZIP code | Mailing timeframes |

|---|

You May Like: Is There Another Stimulus Check Coming In 2022

Sign Up For Direct Deposit Or Update Your Information

Once you choose an option, the next question or an answer will appear below.

Select your payment for direct deposit:

Employment Insurance benefits and leave

Sign up or change your direct deposit information.

- Online:

- 1-800-206-7218

- Find a Service Canada Office close to your home.

Goods and services tax / Harmonized sales tax credit or provincial equivalent

Sign up or change bank information for direct deposit for Canada Revenue Agency payments.

- Online:

- 1-8009598281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in signing up for direct deposit for one or several of your Government of Canada payments.

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Enrolling for this payment will automatically enrol you for any other Canada Revenue Agency payment you are entitled to receive /Harmonized sales tax credit or provincial equivalent).

Climate Action Incentive Payment

Sign up or change bank information for direct deposit for Canada Revenue Agency payments.

- Online:

- 1-800-959-8281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in signing up for direct deposit for one or several of your Government of Canada payments.

- :

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Income tax refund

Canadian

How To Get The Payment

- There is no need to formally apply.

- If you meet all of the SATC eligibility criteria, you automatically qualify to receive the one-time $500 payment via a cheque sent by mail to the residence listed on your 2021 tax return.

- To update your mailing address, please contact the SATC administration centre by email at or by phone at 1-800-667-6102. To update your address, you must provide the following information:

- Your full legal name

- Your Social Insurance Number and

- Your address as it appears on your 2021 tax return.

Read Also: 300 Stimulus Check For Gas

Governor Hochul Announces $672 Million Electric And Gas Utility Bill Relief For New Yorkers

One-Time Bill Credit Available to Help More Than 534,000 New Yorkers Pay Utility Bills

Largest Utility Customer Financial Assistance Program in State History

Governor Kathy Hochul announced today that 478,000 residential customers and 56,000 small businesses in New York State will receive assistance totaling $672 million to pay off unaffordable past due utility bills. Today’s announcement is the largest utility customer financial assistance program in state history and follows a series of policies announced last week to address energy affordability and emissions reductions as part of Governor Hochul’s State of the State address.

“Every New Yorker deserves affordable energy, yet too many New Yorkers are at risk of having their lights turned off due to financial problems caused by the pandemic,” Governor Hochul said. “Earlier this month, I laid out extensive proposals to make energy more affordable in my State of the State address, and with this historic electric and gas utility relief we’re achieving another major milestone to help New Yorkers stay warm during the cold winter months.”

In the June round of bill relief, utility shareholders provided more than $36 million in contributions to benefit customers. In today’s round of bill relief, utility shareholders provided an $101 million to benefit customers an amount that far exceeds any utility contributions for pandemic relief across the United States.

Stimulus Checks 202: State Relief Checks Tax Implications And More Of The Biggest Topics Of 2022

Although the federal government did not issue any economic impact payments aka stimulus checks in 2022, some states took it upon themselves to offer financial relief to eligible residents to offset the effects of inflation and rising gas prices. These inflation relief checks were issued in 17 states in 2022: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Massachusetts, New Jersey, New Mexico, New York, Pennsylvania, South Carolina and Virginia. Payment amounts ranged from $50 to $1,050 for individuals, depending on the state and income level of the recipient.

See: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Given the tough economic times, its no surprise GOBankingRates readers looked for information on future stimulus payments they may be receiving, which states are offering inflation relief payments and when they might expect to receive these payments. These topics and more were among our most-read stimulus stories of the year.

Heres a look at the top 10 most-read stimulus stories of 2022.

You May Like: News On 4th Stimulus Checks

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return

- Received your Golden State Stimulus payment by check

- Received your tax refund by check regardless of filing method

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

State And City Stimulus Checks

Congress has yet to agree on a fourth federal stimulus check, leaving many states to come up with their own programs to help eligible residents.

In California, the Golden State Stimulus II program offers residents over $568million in extra funding through the end of the year.

The program is for residents who have been financially impacted as a result of the pandemic.

Over half a million residents received $285 checks in Maine. In Maryland, qualifying residents can receive a check worth between $300 to $500.

You May Like: Irs Phone Number Stimulus Check

Rhode Island: $250 Rebate Per Child

Rhode Island is sending a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children, for a maximum of $750. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate check distribution began in October. Taxpayers who filed their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December. You can check your rebate status on Rhode Islands Division of Taxation website.

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Also Check: Stimulus Check For People On Social Security

The Irs Has Announced That There Are Only A Few Days Left To Claim Stimulus Checks By Submitting A Tax Return Here Are The Details

The deadline to claim stimulus checks and the 2021 child tax credit is 15 November 2022. The IRS has sent letters to those who have yet to file a tax return and, thus, have left their benefits unclaimed.

For those who have not yet filed a 2021 tax return, one must be submitted to the IRS by the deadline in order to receive the payments, which could total more than $3,200.

The American Rescue Plan, passed by Democrats in March 2021, included a stimulus check worth $1,400 and funds to boost the value of the child tax credit.

In 2021, the value of the child tax credit increased from $2,000 per child to $3,600 per child under six and $3,000 for those between six and seventeen. There are no income minimums, unlike the $2,000 credit, meaning those who may not have submitted a return should do so as soon as possible. For more information, one can look to the IRS and a website dedicated to helping parents and guardians navigate the child tax credit.

Claiming certain #IRS credits may result in a refund, even if youre not otherwise required to file a tax return. Use #IRSFreeFile by Nov. 17, 2022 to prepare and your 2021 tax return electronically for free!

IRSnews

Maine: $850 Direct Relief Payments

Gov. Janet Mills signed a supplemental budget on April 20 to authorize direct relief payments of $850 for Maine taxpayers.

Full-time residents with a federal adjusted gross income of less than $100,000 were eligible. Couples filing jointly received one relief check per taxpayer for a total of $1,700.

Taxpayers were eligible for the payment regardless of whether they owe income tax to the state.

Residents who didnt file a state tax return for 2021 could file through October 31 to claim their payment.

The one-time payments, which are being funded by the states surplus, started rolling out via mail in June to the address on your 2021 Maine tax return.

The supplemental budget also includes an increased benefit for Maines earned income tax credit recipients.

Read more: Everything You Need To Know About Maine Stimulus Checks

You May Like: When Is The Latest Stimulus Check Coming

How Do I Claim My Stimulus Check Step By Step Guide

WHILE some Americans are still owed a stimulus payment, there are a couple of ways for them to claim.

The Treasury Inspector General for Tax Administration has shared a report, revealing several factors as to why payments may be delayed.

Most folks received their stimulus checks by check or direct deposit while others received them in the form of prepaid debit cards.

Some actually mistook these cards as junk mail and threw them out.

The report by TIGTA also said that manually verifying the stimulus claims and debit card policies has delayed the payments for as many as 10million people.

Here’s What Else You Should Know

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Families can also receive $1,400 per dependent, regardless of the dependent’s age.

The Child Tax Credit was also temporarilyextended by Congress to consider more families and increase how much they can receive.

Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. You can check the IRS’s site to determine if you qualify.

Tax returns can also be completed and submitted through CTC’s site, including the simplified filing tool which was updated on Wednesday.

GAO discovered that people within certain groups may have faced difficulty receiving their payments.

This includes those who:

Don’t Miss: Veterans To Receive Stimulus Payment