What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

A Direct Deposit Payment Could Already Be In Your Bank Account Paper Checks Will Follow Quickly

When are second stimulus checks coming? Now! The IRS has already started delivering second-round stimulus checks to millions of Americans who received a first-round payment earlier this year. In fact, initial direct deposit payments have already arrived for some people.

If you dont receive a direct deposit soon, watch your mail for either a paper check or a debit card. The IRS started mailing paper checks on December 30. To speed up delivery, a limited number of people will receive their second stimulus payment by debit card. But the form of payment for your second stimulus check may be different than your first payment. Some people who received a paper check last time might receive a debit card this time, and some people who received a debit card last time could receive a paper check.

If you receive a debit card, dont throw it out thinking its junk mail! The debit cards will be issued by MetaBank, and they will arrive in a white envelope that prominently displays the U.S. Treasury Departments seal. The Visa name will be on the front of the card, and it will say MetaBank on the back. More information about these cards is available at EIPcard.com.

Recommended Reading: How Much Are The Stimulus Checks

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

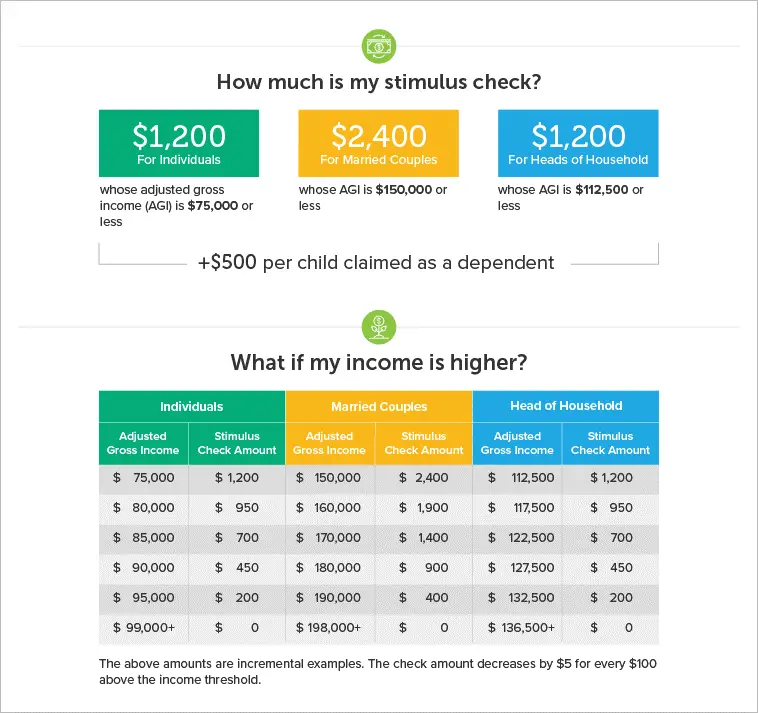

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Also Check: Who Sends The Stimulus Checks

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the Recovery Rebate Credit. You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds youre owed.

Its possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldnt submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

How Is My Second Stimulus Check Calculated

The IRS relies on your tax return to calculate whether you qualify for the second stimulus check. So your eligibility was based on your 2019 tax returns, which you filed by July 15, 2020.

According to the text released by Congressional leaders, the COVID-19 relief bill notes those with an adjusted gross income over certain limits receive a reduced amount of money, with the checks phasing out entirely at higher incomes.

Your AGI is calculated by subtracting the deductions that you made during the tax year from your gross income .

Heres a quick breakdown of the AGI limits for the $600 stimulus checks:

- Single filer checks begin to phase out at AGIs above $75,000.

- Head of household checks start getting phased out at incomes over $112,500.

The IRS reduces stimulus payments by 5% for the total amount that you made over the AGI limit. This means that for every $100 that you make over the limit, your check goes down by $5. At high enough incomes, the checks phase out entirely. So if you earned over $87,000 as an individual taxpayer, $174,000 as a joint filer, or $124,500 as a head of household, you do not get a stimulus payment. The following calculator allows you to calculate your benefit amount:

This second round of stimulus checks is currently half the maximum amount of the first stimulus checks that were included in the CARES Act in March.

You May Like: H& r Block Stimulus Check 2

New Yorker Pitchfork And Ars Technica Unions Authorize Strike

Union workers at The New Yorker, Pitchfork and Ars Technica said Friday they had voted to authorize a strike as tensions over contract negotiations with Condé Nast, the owner of the publications, continued to escalate.

In a joint statement, the unions for the three publications said the vote, which received 98 percent support from members, meant workers would be ready to walk off the job if talks over collective bargaining agreements continued to devolve. At The New Yorker, the unionized staff includes fact checkers and web producers but not staff writers, while most editors and writers at Pitchfork and Ars Technica are members.

The unions, which are affiliated with the NewsGuild of New York, which also represents employees at The New York Times, have been separately working toward first-time contracts with Condé Nast. In the case of The New Yorker Union, negotiations have dragged out for more than two years.

The core of their demands, the unions said, were fair contracts that included wage minimums in line with industry standards, clear paths for professional development, concrete commitments to diversity and inclusion, and work-life balance. They said in the statement that Condé Nast had not negotiated in good faith.

Condé Nast has long profited off the exploitation of its workers, but that exploitation ends now, the statement said.

The NewsGuild of New York said it would hold a rally for fair contracts on Saturday at Condé Nasts offices in downtown Manhattan.

Amount Of Third Stimulus Checks

Question: How much money will I get?

Answer: Everyone wants to know how much money they will get. You probably heard that your third stimulus check will be for $1,400 but its not that simple. Thats just the base amount. Your check could actually be much higher or lower.

To calculate the amount of your check, Uncle Sam will start with that $1,400 figure. If youre married and file a joint tax return, then both you and your spouse will get $1,400 . If you have dependents, you get an additional $1,400 for of them. So, for example, a married couple with two children can get up to $5,600.

Now the bad news. Stimulus payment amounts will be phased-out for people at certain income levels. Your check will be gradually reduced to zero if youre single with an adjusted gross income above $75,000. If youre married and file a joint tax return, the amount of your stimulus check will drop if your AGI exceeds $150,000. If you claim the head-of-household filing status on your tax return, your payment will be reduced if your AGI tops $112,500. You wont get any payment at all if your AGI is above $80,000 , $120,000 , or $160,000 .

Also note that the IRS, which is issuing the payments, will look at either your 2019 or 2020 tax return for your filing status, AGI, and information about your dependents. Because of this, the amount of your third stimulus check could depending on when you file your 2020 tax return.

Recommended Reading: New Round Of Stimulus Check

Recommended Reading: I Never Got My California Stimulus Check

The American Rescue Plan Act Will Provide 160 Million Americans With A Stimulus Check Of Up To $1400 We Look At The Three Rounds Of Aid Since The Pandemic Started

On , the World Health Organization officially declared the Coronavirus situation a pandemic. Just over a year on and the United States remains the worst hit with the total number of reported cases at 30,332,358 and 550,073 deaths related to the virus, according to todays figures. The Covid-19 pandemic also caused sweeping job losses, with unemployment hitting a high of 14.8% during April 2020 the worst month of the crisis. Unemployment figures have since recovered and currently stand at 6.2% as of March 2021. That prompted lawmakers to draw up the first Covid-19 Relief Bill to bring economic aid to Americans either struggling to make ends meet or who had lost income because of the pandemic.

Not Too Late To File For A Payment

Most people should receive their $1,400 stimulus checks and plus-up payments, if theyre eligible, automatically, according to Erica York, economist at the Tax Foundation.

Payments that are still outstanding mostly represent people who are more difficult to reach, such as those who have no incomes or bank accounts, York said.

The IRS recently issued guidance for those who are homeless explaining that they may still qualify for stimulus check money, as well as the expanded child tax credit, even if they do not have a permanent address or bank account. Others may miss out on the earned income tax credit if they dont file.

The IRS is working to find hard-to-reach populations, but it is likely they wont get absolutely 100% of the people who may qualify, York said.

If you did miss that filing deadline this year, its not too late to file a return.Susan Allensenior manager for tax practice and ethics at the American Institute of CPAs

In the beginning of this year, for example, there were still an estimated 8 million outstanding stimulus checks from the CARES Act, which was passed in March 2020.

The good news is that its not too late to claim that money.

If you did miss that filing deadline this year, its not too late to file a return, said Susan Allen, senior manager for tax practice and ethics at the American Institute of CPAs.

You can still file and claim that refund, she said.

Whats more, you will not owe the IRS a late-filing penalty if you are due money back.

Read Also: Is The Homeowners Stimulus Real

Are More Stimulus Checks Coming After The $1200 Payments

Congress is currently considering additional stimulus checks. The House passed this bill that includes a second round of $1,200 stimulus checks, but the Senate has to decide if it will agree to additional stimulus checks before anything can become law. Basically, the momentum is moving in the direction of Congress passing another stimulus check, and the expectation is that House and Senate negotiations will occur in June. To learn more details about the second stimulus check, read this article: 5 Facts On The Second Stimulus Check.

California Middle Class Refund Checks

Starting in October, millions of Californians will receive inflation relief checks of up to $1,050, either as a direct deposit or in the mail as a debit card. The payments are coming out of Californias $97 billion budget surplus. The state expects 95% of the payments to go out in 2022, with the remaining checks due .

How much California residents will receive is based on income, tax-filing status and household size from their 2020 tax return.

- Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will receive $350 per taxpayer and another $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050.

- Individual filers who make between $75,000 and $125,000 a year and couples who earn between $150,000 and $250,000 will receive $250 per taxpayer, plus another $250 if they have any dependents. A family with children could therefore receive a total of $750.

- Individual filers who earn between $125,000 and $250,000 and couples who earn between $250,000 and $500,000 annually would receive $200 each. A family with children in this bracket could receive a maximum of $600.

Single taxpayers earning $250,000 or above and couples earning a combined $500,000 are ineligible for the payments.

Don’t Miss: When Will Arizona Get Stimulus Checks

How To Claim Your Stimulus Money

The first step is to figure out how much in missing stimulus payments youll need to claim on your 2020 tax returns.

The IRS, which began accepting tax returns on February 12, calls the checks recovery rebate credits on its tax forms. Thats because, technically, the payments were actually tax rebates paid in advance of filing your taxes. Most taxpayers have until April 15 to file their taxes, although the IRS on February 22 said Texas residents will receive another two months to file, due to the winter storms that battered their state.

To help determine if you are owed more, the IRS published a Recovery Rebate Credit worksheet, which asks questions about eligibility and how much you received in the two stimulus checks so far. If you find that you are owed more, you can enter the amount on line 30 on IRS Form 1040.

If you dont recall how much you received in the first two rounds of stimulus payments, you can create or view your account at the IRS website. Extra stimulus money will be included with your tax refund. Most taxpayers will receive their refund within 21 days, according to the tax agency.

With Congress now working on a third relief package, millions of households could receive a third stimulus check within the next several weeks, which happens to fall in the middle of tax filing season.

Dont Miss: I Never Got Any Of The Stimulus Checks

How Will The Irs Send My Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, your payment will be distributed in the same method as your benefits. Learn more to see if this applies to you.

Economic Impact Payments will either be directly deposited into your bank account or a check or prepaid debit card will be mailed to you.

You May Like: How Do I Qualify For $600 Stimulus In California

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Were Willing To Do It This Week

Congress was hoping to reach a coronavirus stimulus deal before breaking for a scheduled recess, which began August 10 and will last through September 8. While many lawmakers have returned home for the summer break, they will remain on 24-hour notice to return to Washington in case a deal is reached.

Treasury Secretary Steven Mnuchin expressed optimism Monday, saying Democratic leaders seemed willing to compromise.If we can get a fair deal, were willing to do it this week, Mnuchin said in an interview on CNBCsSquawk on the Street.

The Treasury secretary spoke after President Trump issued executive orders over the weekend to establish a payroll tax holiday, defer student loan payments through 2020, extend the federal protections from evictions, and provide additional unemployment benefits. But it remains to be seen whether or not the presidents orders will actually come to fruition. Thats because continuing these aid programs initiated as part of the CARES Act would require federal funding, which Congress controls.

Unemployment aid seems to be the major sticking point in negotiations. Lawmakers are at odds over how much extra federal unemployment to provide to jobless workers. Under the CARES Act, eligible Americans received an extra $600 per week until July 31. Democrats want to continue the extra $600 per week through January. Republicans have proposed reducing that to $200 per week through September, followed by 70% wage replacement through December.

Read Also: Stimulus Checks Status Phone Number