Stimulus Checks: Why You Might Not Be Able To Track Your Payment

About 80 million Americans received their stimulus checks last week, slightly more than half of the country’s 150 million taxpayers. That means millions are still waiting for their payments, with many of them turning to the IRS’ “Get My Payment” service for an update on when the money will land.

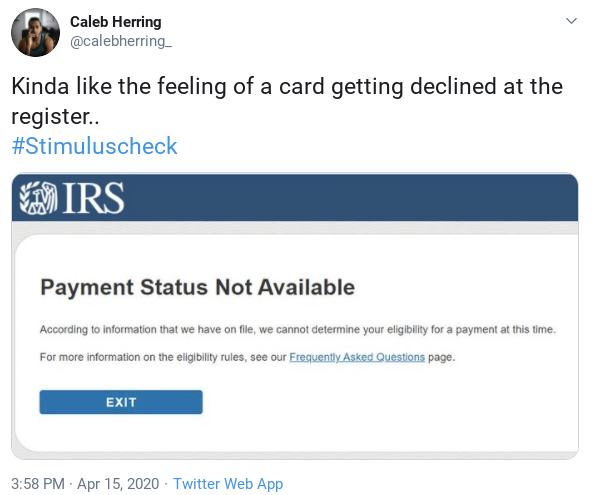

Yet the rollout of the “Get My Payment” service on April 15 wasn’t entirely smooth. Dozens of consumers reached out to CBS MoneyWatch to complain that they were unable to find information about their checks, with many receiving a statement that read, “Payment status not available.” Others said their payments were sent to the wrong bank accounts.

The IRS and U.S. Treasury Department have provided more information in the last few days about why some consumers haven’t been able to track the progress of their checks. While it might not clear up every problem, it could explain why many taxpayers are still in the dark.

The rollout of the stimulus checks has been eagerly anticipated as millions of Americans struggle to pay their bills amid a blizzard of layoffs. About 1 in 7 workers has lost their job in the last month, with state economies shuttering in a bid to contain the coronavirus. The stimulus checks $1,200 for single taxpayers earning less than $75,000 and $2,400 for married couples earning less than $150,000 are geared toward helping households weather the crisis.

When Should You Call The Irs For Your Tax Refund

Internal Revenue Service, also known as IRS, has given an option to contact them under some circumstances. They have mentioned these reasons on its official website, and if you fall under any of these reasons, you should contact them.

If you have filed your income tax return and it has been more than 21 days, you should call the IRS for your tax refund. Apart from that, if you are trying to check your tax refund using the wheres my refund tool and the tool tells you to contact, you should contact the IRS for your tax refund.

Usually, the Internal Revenue Service contacts you by mail if they need any further information to process your income tax return.

You should expect a natural delay if you mailed a paper return or responded to an IRS inquiry about your return.

What You Can Expect

Look on the following list for the action you took whether thats sending us your individual or business tax return or answering a letter from us. Then, open the action to see how long you may have to wait and what to do next.

Filed a Tax Return

The IRS is opening mail within normal timeframes and all paper and electronic individual returns received prior to January 2022 have been processed if the return had no errors or did not require further review.

As of August 26, 2022, we had 8.2 million unprocessed individual returns received in calendar year 2022. These include tax year 2021 returns and late filed tax year 2020 and prior returns. Of these, 1.7 million returns require error correction or other special handling, and 6.5 million are paper returns waiting to be reviewed and processed. This work does not typically require us to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund and in some cases this work could take more than 120 days. If a correction is made to any Recovery Rebate Credit, Child Tax Credit, Earned Income Tax Credit or Additional Child Tax Credit claimed on the return, the IRS will send taxpayers an explanation. Taxpayers are encouraged to continue to check Tax Season Refund Frequently Asked Questions.

Sent a Missing Form or Document

You May Like: Gas Stimulus Check 2022 California

How To Check The Status Of Your Coronavirus Stimulus Check

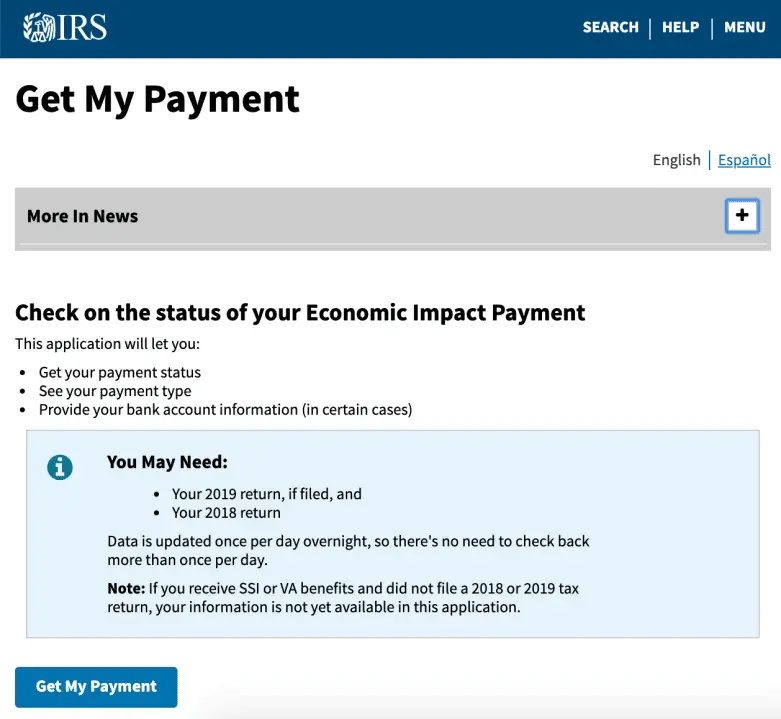

If youre trying to find out the status of your coronavirus stimulus payment, go to the IRSs Get My Payment page. You can learn whether your payment has been issued, and if its coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Will We Get Another Federal Stimulus Check

The third payment was probably the last one you will get for the foreseeable future. Democrats passed the third stimulus check through budget reconciliation, which allowed them to pass it with a simple majority vote in the Senate.

There is a limit on the number of times Democrats can use reconciliation and the Republicans have made it clear theyre not going to provide further COVID relief. Therefore, it is unlikely that a fourth stimulus check will be authorized.

Also Check: Never Received Any Stimulus Checks

How To Use Irs Get My Payment

The IRS also updated frequently asked questions Saturday on how to use the Get My Payment tool, which requires users to enter their full Social Security number or tax ID number, date of birth, street address and ZIP code.

But before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS. Our phone assistors dont have information beyond whats available on IRS.gov.

The tool will show the status of when a payment has been issued and the payment date for direct deposit or mail, according to the frequently asked questions. Some will get a message that says Payment Status Not Available.

If you get this message, either we have not yet processed your payment, or you are not eligible for a payment, the IRS said. We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.

And others will get a Need More Information message when using the tool if the payment was returned to the IRS because the post office was unable to deliver it for another reason.

If your address has changed the IRS says the easiest way to update is to file your 2020 tax return with your current address, if you havent already done so. Once we receive your current address, we will reissue your payment.

Contributing: Jessica Menton, USA TODAY

Follow USA TODAY reporter Kelly Tyko on Twitter:

What If You Have Trouble With The Tool

To use the Get My Payment tool, you must first verify your identity by answering security questions. If the information you enter does not match IRS records, you will receive an error message. To avoid this:

- Double-check the information requested

- Make sure what you enter is accurate

- Try entering your street address in a different way and

- Use the US Postal Services ZIP Lookup tool to look up the standard version of your address, and enter it into exactly as it appears on file with the Postal Service.

If your answers do not match the IRS records three times, youll be locked out of Get My Payment for security reasons. If that happens, you must wait 24 hours and try again. If you cant verify your identity, you wont be able to use Get My Payment. Unfortunately, theres no fix for that: the IRS says not to not contact them.

However, if you verified your identity and received Payment Status Not Available, this means that the IRS cannot determine your eligibility for a payment right now. There are several reasons this could happen, including:

- You didnt file either a 2018 or 2019 tax return or

- Your recently filed return has not been fully processed.

Again, the IRS says theres no fix for that and you should not contact them.

Don’t Miss: How Do I Know If I Got My Stimulus Check

Why You Get A ‘payment Status Not Available’ Message

You can use the Get My Payment app to find out the projected date when your deposit is scheduled to arrive in your bank account. The Get My Payment tool will also tell you if you’re set to receive payment by paper check, along with a scheduled arrival date in the mail. However, there could be several reasons why you can’t get a status update on your stimulus payment right now.

The IRS says that through midday on Wednesday, April 15, that over 6 million taxpayers had successfully found out their payment status through the new Get My Payment app. If instead, your inquiry resulted in a “Payment Status Not Available” message, the IRS says that this could be because:

- You are not eligible for a payment.

- You have not filed a tax return in tax year 2018 or 2019.

- You filed your tax return recently and it’s still being processed, or you provided information through Non-Filers: Enter Your Payment Info on IRS.gov.

- You receive Social Security, or are a RRB Form 1099 recipient, SSI or VA benefit recipient. Status updates for these recipients is not yet available through the Get My Payment app.

Here are more explanations for why you can’t get a payment status update, or why your check simply hasn’t come yet. If you cannot get a status update on your payment, the IRS says that you should check back 24 hours later and try again then.

Can I Change My Bank Account Information

If youve closed the bank account the IRS has on fileor the organization has incorrect informationthat will cause a delay. Banks will return stimulus payments to the IRS, which will then mail you a physical check.

The portal does not enable you to update your bank informationand the IRS is asking people not to call, as its phone staff are unable to change the information on file.

The best way to make a change, the IRS says, is to file your 2020 taxes with your current address and updated account information. Just be aware this could impact the amount you receive if your adjusted gross income rose above $75,000 last year.

Also Check: 4th Stimulus Check For Veterans

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Also Check: How To Get The 1400 Stimulus Check

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

What Are The Major Tax Refunds This Year

After the first spread of the novel coronavirus in the United States of America, the federal government announced several tax reforms and new financial reliefs.

Nowadays, there are several things that you can track for your tax refund this year. As usual, if you have overpaid your taxes in the year 2021, then you are eligible to receive that money back as a tax refund.

Apart from that, if you are a parent, you could also receive child tax credit money. The government announced that they are going to release 3600 U.S. dollars per child.

You can also expect reimbursements for the money you spent on childcare-related expenses last year. Many people also missed their third stimulus payment, which can also be claimed in your tax refund.

These are the few major tax refunds that you can expect this year. Other than that, if you are eligible for an unemployment insurance claim, then you can also expect that in your tax refund.

IR-2021-54, March 12, 2021

WASHINGTON The Internal Revenue Service announced today that the third round of Economic Impact Payments will begin reaching Americans over the next week.

Following approval of the American Rescue Plan Act, the first batch of payments will be sent by direct deposit, which some recipients will start receiving as early as this weekend, and with more receiving this coming week.

Read Also: Total Stimulus Payments In 2021

Usps Is A Good Way To Track Your Paper Check

If your third stimulus check is going out in the mail, the US Postal Service has a free app that can notify you when it’s about to deliver your stimulus money from the IRS. Informed Delivery is a mail-tracking service that automatically scans your letters and alerts you to when they’ll be delivered. Here’s more on how to set up and use the letter-tracking service from the USPS to keep tabs on your payment.

Penalty Relief For Certain 2019 And 2020 Returns

To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36PDF, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The IRS is also taking an additional step to help those who paid these penalties already. To qualify for this relief, eligible tax returns must be filed on or before September 30, 2022. See this IRS news release for more information on this relief.

Also Check: Irs Social Security Stimulus Checks Direct Deposit 2022

‘payment Status Not Available’ Or ‘need More Information’

Eldorado, El Camino, Barracuda: Could these long-gone vehicles make a comeback?

Some will get a message that says “Payment Status Not Available.”

“If you get this message, either we have not yet processed your payment, or you are not eligible for a payment,” the IRS said. “We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.”

And others will get a “Need More Information” message when using the tool if the payment was returned to the IRS because the post office was unable to deliver it for another reason.

If your address has changed the IRS says the easiest way to update is to “file your 2020 tax return with your current address, if you havent already done so. Once we receive your current address, we will reissue your payment.”

In the coming weeks, more batches of payments will be sent via direct deposit and through the mail as a check or debit card, according to the agency. Some people may see the direct deposit payments as pending or as provisional payments in their accounts before the official payment date of March 17, the IRS added.

COVID-19 relief payments are going to the wrong accounts: Stimulus checks going to wrong bank accounts for some Americans

Contributing: Jessica Menton, USA TODAY

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko

Here’s What Veterans And Ssi Ssdi Beneficiaries Should Know

The IRS tracking tool Get My Payment is designed to tell you the status of your third stimulus check. People who receive Social Security benefits like SSDI and SSI and veterans who don’t file taxes can also see their payment status in the tracker tool. Tens of millions of Social Security recipients and veterans should have already received their $1,400 payment.

You May Like: Only Received One Stimulus Check

What Can ‘get My Payment’ Tell Me

The ‘Get My Payment’ portal launched soon after the CARES Act, which included the first stimulus payment. The Internal Revenue Service tool is designed to give status information to those expecting stimulus payments. However, the IRS’s responses on the site sometimes require some clarification.

Many people will receive a payment status message stating that their payment has been processed. The message will also include a payment date and how the payment is to be sent, meaning direct deposit or mail. Other people will be told that they’re eligible, though the payment is awaiting processing. No date will be given, because it is pending.

‘Get My Payment’ may also state that your payment status is not available. That could mean that the IRS has not processed the payment, does not enough information to send out a payment, or the potential recipient is ineligible.

The portal could instead say that more information is needed. That means the post office failed to deliver your payment and returned it to the IRS. According to the Agency, the best way to update an address is to submit a 2020 tax return.

The tool could also tell you to try again later. The system limits a user to three failed login attempts and five successful logins over 24 hours. So receiving this message could mean that your information doesn’t match what the IRS has on file or that you have logged in too many times.