How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

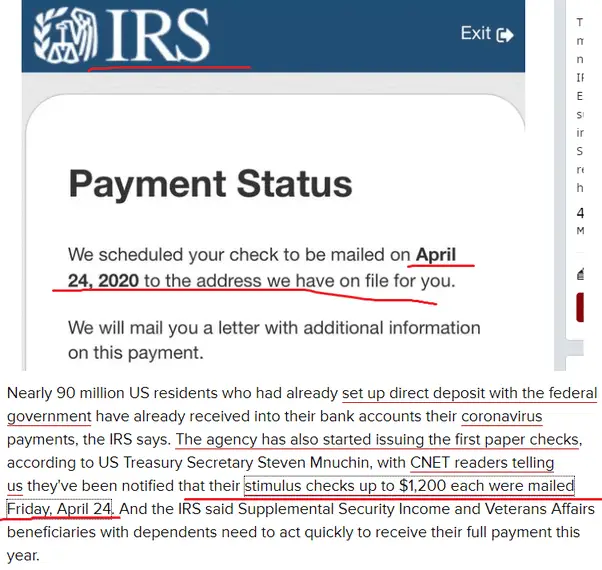

What Will The Status Report Look Like

For third-round stimulus checks, the Get My Payment tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that mail means either a paper check or a debit card. If you dont recognize the bank account number displayed in the tool, it doesnt necessarily mean your deposit was made to the wrong account or that theres a fraud. If you dont recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesnt have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, youll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you dont provide any account information, the IRS cant reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, theres no reason to check the portal more than once per day.

When Will I Get My Stimulus Check

Californians who received money from either round of Golden State Stimulus payments were the first to receive direct deposits, which should have arrived before Oct. 25. The remainder of direct deposits were reportedly issued between Oct. 28 and Nov. 14. But if you changed your banking information since filing your 2020 tax return — or never set up direct deposit in the first place– you should expect to receive a Money Network debit card instead.

California taxpayers who didn’t set up direct deposit will receive special debit cards in the mail.

Cards will be mailed between Dec. 17, 2022, and Jan. 14, 2023, according to the Franchise Tax Board, which said it expects 95% of all MCTR payments — direct deposit and debit cards — to be issued by the end of 2022.

Keep in mind that some tax returns “require additional review,” the FTB said, according to KGET, which could delay your deposit or mean you’re getting a debit card instead. Below is an estimated payment schedule for various categories of recipients.

Also Check: When Did I Receive My Stimulus Check

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

Youre claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

Recommended Reading: Still Havent Got My Stimulus Check

Also Check: How Do I Get The First Stimulus Check

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Read Also: How Can I Cash My Stimulus Check Without An Id

Coronavirus Aid Relief And Economic Security Act

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief takes many shapes, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Let’s take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

How Can I Get My Money Faster

The IRS is first sending money to those for whom it has bank account information on file. That might not be you if you havent received a tax refund over the past two years or if you received a refund by a check in the mail, rather than by a direct deposit.

But the Get My Payment tool, which launched Wednesday, will also allow taxpayers to input their bank account information so that they can receive the money electronically rather than by a paper check which could take weeks, or even months.

To do so, a taxpayer will need to submit their adjusted gross income from their most recent tax return, the refund or amount owed that year, as well as the account and routing numbers for their bank account.

However, taxpayers wont be able to update their bank information once the payment is already scheduled for delivery, and it wont allow you to update bank information already on file, the Treasury Department said.

Don’t Miss: Irs Get My Payment 3rd Stimulus Check

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

How Do I Find Out How Many Stimulus Checks I Received In 2021

Asked by: Mr. Devante West

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

Also Check: Stimulus Checks Status Phone Number

Do I Need To File My Taxes To Get A Stimulus Payment

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

- Veterans Affairs

- Railroad Retirement

Don’t Miss: What Is Congress Mortgage Stimulus Program

How Do I Receive My Stimulus Check

The IRS has stated that people currently receiving Social Security benefits will automatically receive their stimulus checks without having to do anything extra. The money should be deposited directly into your bank account if you provided direct deposit information during your last tax filing.

If not, then a paper check will be sent to the address listed in your most recent tax return or Social Security Administration records.

After much pressure, the IRS conceded to use current information on 1099 benefits statements to distribute the stimulus check. Initially, the plan was to ask individuals to complete a separate form. However, if you still havent received your stimulus check but believe you are qualified for one, then check with the local SSA or IRS office.

How To Check Your Stimulus Payments History

In order to see which Economic Impact Payments you have received and for how much, you can have a look at Your Online Account on the IRS website.

You will have to sign in first before you can access any information, but once you have entered the system, you will be able to see the first, second and/or third payment amounts from the Economic Impact Payments under the Economic Impact Payment Information, which can be located on the Tax Records page.

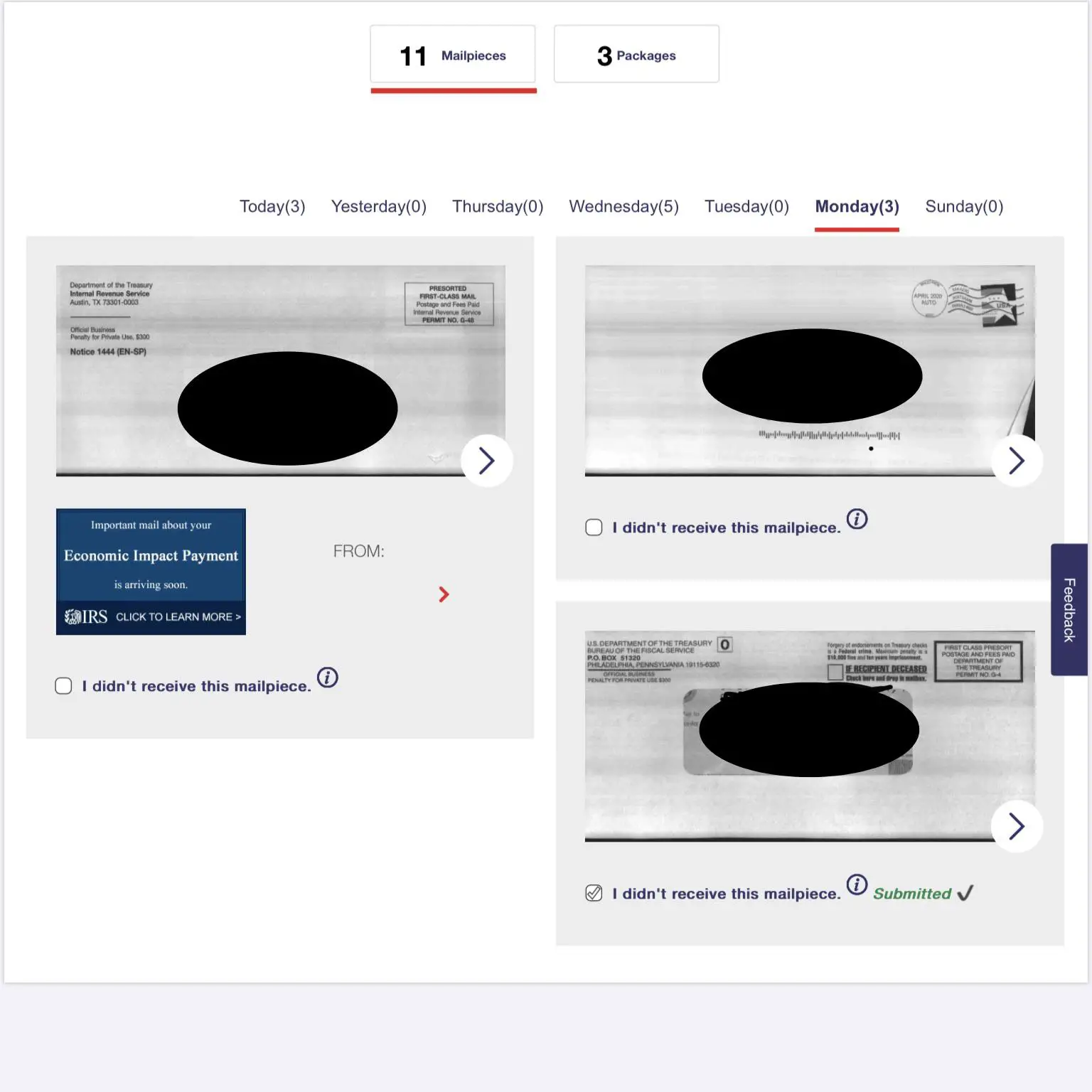

Alternatively, you might not even have to go onto the IRS website in order to have a look. If you have your mailed checks from the IRS, you will find that Notice 1444 was in relation to the first Economic Impact Payment that was sent in the 2020 tax year Notice 1444-B was in relation to the second Economic Impact Payment that was sent in the 2020 tax year and Notice 1444-C was in relation to the third Economic Impact Payment that was sent in the 2021 tax year.

The other letter that you are likely to received this has only begun to be sent out since March 2022, so it might not have arrived yet is Letter 6475, which confirms the total amount of the third Economic Impact Payment and any plus-up payments you were sent in the 2021 tax year.

Read Also: Who Will Receive The Next Stimulus Check

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- 16:56 ET, May 13 2021

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief

Dont Miss: How To Check Eligibility For Stimulus Check

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Read Also: New Home Purchase Stimulus Program

What To Do If One Of The Three Stimulus Checks Hasnt Arrived

About 15 days after the IRS sends out your check, you should receive a letter from the agency confirming the payment. When the first round of stimulus checks went out last year, that letter included two hotline phone numbers because thousands of agents were available to help. But with the second and third rounds of checks, the IRS changed its tune, and these phone numbers may be disconnected.

Here are common scenarios that might indicate you need to look into your stimulus payment:

- If youre one of the millions of people who qualified for the first stimulus check but never got it.

- If your second stimulus check has still not arrived.

- If you got a letter from the IRS saying your third check was sent, but never received the payment. Or, if the IRS Get My Payment portal said your payment was sent, but you didnt get it.

- If you got some of your stimulus money from any payment, but not all of it.

You should also confirm youre qualified to get the stimulus payment, since not everyone who received a previous check is qualified this time. If you think its time to take action, read for more options.

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

You May Like: Fourth Stimulus Check Irs.gov