How Soon Will They Arrive

The stimulus distribution has been halted due to President Trump’s demand for more money.

On December 25, the president tweeted that he had made “many calls” to increase the amount for US citizens saying: “Made many calls and had meetings at Trump International in Palm Beach, Florida. Why would politicians not want to give people $2000, rather than only $600?

Adding: “It wasnt their fault, it was China. Give our people the money!”

President-elect Joe Biden lashed out at Trump for not signing the bill into law.

“This abdication of responsibility has devastating consequences,” Biden said in a statement Saturday.

“It is the day after Christmas, and millions of families don’t know if they’ll be able to make ends meet because of President Donald Trump’s refusal to sign an economic relief bill approved by Congress with an overwhelming and bipartisan majority.”

If Trump decides to sign the agreed-upon bill, the IRS and Treasury could start sending out the payments shortly after January 1.

This is a significantly shorter timeline than the 19 days it took when the Cares Act was passed.

“I can get out 50 million payments really quickly. A lot of it into people’s direct accounts,” Mnuchin said back in August but different groups will be prioritized for different reasons.

It also depends what form of payment you’ll be getting i.e. direct deposit or a check. First in line will be those who got it directly into their accounts.

Keeping Track Of The California Earned Income Tax Credit

For the first time ever, undocumented workers will also be eligible for the California Earned Income Tax Credit this year. This rebate for Californians who earn up to $30,000 can provide as much as $3,027 depending on the number of children you have.

This will also be included in your state taxes. Qualifying for the EITC means you qualify for the Golden State Stimulus, López said. Households that get the state EITC will also be eligible for that one-time $600 pandemic stimulus payment.

But to be eligible, make sure you include the California Earned Income Tax Credit FTB 3514 form in your filing, or make sure to ask your tax preparer. Learn more about organizations offering free tax assistance in the Bay Area here.

In the case of families with mixed status, where the head of household is undocumented and the spouse or children have a legal immigration status, that is not an obstacle any more to receive the California EITC. If the taxpayer has a valid ITIN number and makes under $30,000, they should qualify, López pointed out.

While ITIN holders qualify for the California EITC, they still are ineligible for the federal earned income tax credit.

López also highlighted how important it is to distinguish between government aid like stimulus checks and rebates and taxable benefits like unemployment.

There Is Little Talk Of More Payments Despite Record Covid

Covid-19 cases in the US are continuing to rise follow latest news with never before seen numbers of cases rocking the country. The latest national figure, from January 9, had 313,061 new cases. While this increase, more than 200 percent higher than two weeks ago, is large, it isnt reflected by a similar increase in deaths. Compared to two weeks ago, 16 percent more people have died. Cases are looking like they are peaking, but reported cases are always lower on weekends, so a fuller picture will be known later in the week.

While the situation was looking especially grim at the turn of the new year, vaccines are continuing to be effective against serious illness. Despite cases being at the worst level of the pandemic, there has been no move in Congress to pass another stimulus check.

How contagious is Omicron?

Sam Ghali, M.D.

A more pressing concern has been the amount of people needing to be off work while isolating with the disease. This has been a contributing factor in the CDC reducing the recommended time to isolate with the illness. Now, people need only isolate for five days, with no requirement to test negative before returning to work. This has garnered criticism as people are potentially being pushed back into the workplace while they could be infectious to others.

Don’t Miss: When Was The 3rd Stimulus Payment Issued

Support For A Fourth Stimulus Check

A group of Democratic Senators, including Ron Wyden of Oregon, Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont, sent a letter to President Joe Biden at the end of March requesting recurring direct payments and automatic unemployment insurance extensions tied to economic conditions.

As the Senators reasoned in their letter, this crisis is far from over, and families deserve certainty that they can put food on the table and keep a roof over their heads. Families should not be at the mercy of constantly-shifting legislative timelines and ad hoc solutions.

An earlier letter to President Biden and Vice President Kamala Harris from 53 Representatives, led by Ilhan Omar of Minnesota, carved out a similar position. Recurring direct payments until the economy recovers will help ensure that people can meet their basic needs, provide racially equitable solutions, and shorten the length of the recession.

Additional co-signers included New Yorks Alexandria Ocasio-Cortez and Michigans Rashida Tlaib, two other notable names among House Progressives. The letter didnt place a number on the requested stimulus payments. But a tweet soon after put it at $2,000 per month for the length of the pandemic.

$2,000 monthly payments until the pandemic is over.

READ MORE:

You May Like: Where To Cash My Stimulus Check

Your Bank Account Number

When you file your taxes, make sure you use your current banking information if you would like your payment through direct deposit.

Typically, youll receive this payment using the refund option you select on your tax return. If you received an advanced refund through your tax service provider or paid your tax preparation fees using your refund, youll receive your payment by check in the mail.

Read Also: 4th Stimulus Check For Single Person

Oregon To Begin Sending $600 Stimulus Payments To Low

Oregon lawmakers in March approved the one-time stimulus payments for certain low-income workers. Beth Nakamura/The OregonianBeth Nakamura/The Oregonian

More than 200,000 Oregon workers will receive $600 checks from the state as soon as this week.

Oregon lawmakers in March approved the one-time stimulus payments for certain low-income workers. The payments will go to Oregonians who claimed the Earned Income Tax Credit in 2020, a tax break for low-income working households, and lived within the state in the last six months of that year.

The Oregon Department of Revenue said Wednesday that it would distribute nearly $141.8 million to 236,000 qualifying households. Payments are limited to one per household.

About $82 million will be deposited directly into the bank accounts of qualifying individuals, while the remaining nearly $60 million will be sent via mail. The state said qualifying individuals will receive the money no later than July 1.

The state is paying for the stimulus payments with federal pandemic aid approved by Congress last year.

Rich Hoover, a spokesperson for The Oregon Department of Revenue, said the payments are not subject to state or federal income tax.

Oregonians with questions can email The Oregon Department of Revenue at .

The Latest On $1400 Stimulus Checks

This tax season, the government is also issuing a third tranche of third stimulus checks for up to $1,400 per individual, plus $1,400 per eligible dependent.

Last week, the IRS and other agencies said about 127 million checks have been sent to date, for a total of approximately $325 billion.

Those $1,400 payments are generally based on 2019 or 2020 tax returns, whichever was most recently filed and processed by the IRS. Those who used the IRS non-filer tool last year should also automatically get their payments.

There are also advantages to filing a 2020 return in order to receive the $1,400 payment, according to the IRS.

If your income dropped from 2019 to 2020, you could be eligible for a larger payment. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed.

Filing a 2020 tax return also lets you update your direct deposit information.

This tax season, non-filers are also required to file a tax return in order to get their payment, provided they have not already submitted their information to the government.

Of note, people who receive federal benefits such as Social Security, Supplemental Security Income, Railroad Retirement Board and Veterans Affairs will generally receive their stimulus checks automatically, though there have been delays in processing some of those payments.

You May Like: How Do I Get Another Stimulus Check

Second Stimulus Check: Who Won’t Be Getting A $600 Check

The second round of federal stimulus checks are now hitting bank accounts following President Donald Trump’s signing of the $900 billion stimulus bill last week. Last-minute passage of the relief legislation will offer a modest lift to the 60% of Americans who have suffered financial woes due to the coronavirus pandemic, yet millions may be disappointed to discover they’re among the groups who don’t qualify for the payment.

The checks will amount to $600 for each qualifying adult and child half the amount of the $1,200 checks sent out earlier this year. The $600 per-person payments are part of the stimulus bill passed by Congress in December and signed by Mr. Trump on the evening of December 27.

Efforts by Mr. Trump and Democratic leaders to boost the so-called Economic Impact Payments to $2,000 per adult have stalled after Senate Majority Leader Mitch McConnell in December blocked an attempt to vote on the issue. Wall Street analysts say the push has only a slim chance of moving forward, noting the additional hundreds of billions of dollars the larger payment would cost.

“Children will be eligible for the same benefit amount as eligible adults, and families with members of mixed immigration status with a valid Social Security number for one spouse are also eligible for the payments, unlike with the CARES Act rebates,” noted the Tax Foundation.

When Will A Second Stimulus Check Be Issued

The government began sending direct deposit payments on December 28, 2020. Paper checks were sent out starting on December 30, 2020.

Payments are automatically sent to:

- Eligible individuals who filed a 2019 tax return.

- Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security and Veteran Affairs beneficiaries.

- Individuals who successfully registered for the first stimulus check online using the IRS Non-Filers tool or who submitted a simplified tax return that has been processed by the IRS

There is no action that you have to take to get your second stimulus check. People who provided their banking information with the IRS shouldve received their stimulus checks by direct deposit. Social Security and Veterans Affairs beneficiaries who received the first payment via Direct Express shouldve received the second payment the same way.

The IRS sent paper checks or prepaid debit cards to people who did not provide their banking information. Mailed payments may be delivered in a different format than the first stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Read Also: 2nd And 3rd Stimulus Checks

Who Gets The $600 Checks

The checks would represent half of the amount directed to most U.S. households in the spring, when the Coronavirus Aid, Relief and Economic Security Act authorized $1,200 checks for eligible adults.

However, under the bill passed by Congress this month, one group of people would receive more money in the second round of stimulus checks than the first: dependent children, who would receive the same $600 checks as adults, up from the $500 checks that children received through the CARES Act in the spring.

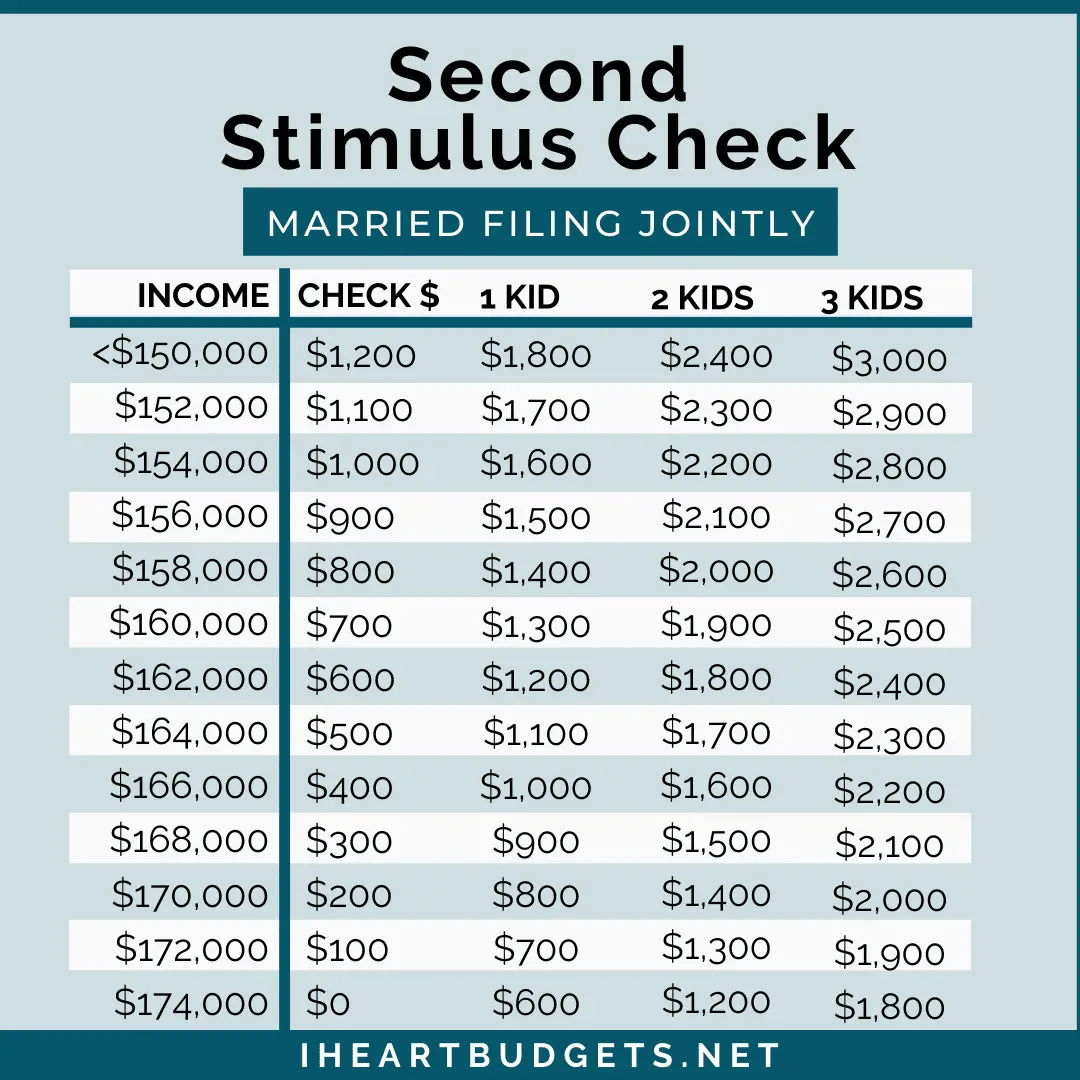

Single people earning up to $75,000 would receive $600, while married couples earning up to $150,000 would receive $1,200.

The second round of checks would have the same type of income phaseouts as in the CARES Act, with the stimulus check payments reduced for earnings above $75,000 per single person or $150,000 per married couple.

The amount of payment individuals receive would be reduced by $5 for every $100 of income earned above those thresholds, according to the House Appropriations committee. That’s similar to the CARES Act, but fewer higher-earning taxpayers would qualify for the checks under this formula when compared with the earlier bill.

To check on how much you might receive, you can go to Omni Calculator’s second stimulus calculator for an estimate.

Stimulus Payment Updates: Who Will Get These $600 Checks This Week

Nearly 141.8 million dollars will be distributed to qualifying households in Oregon

- American Finances Updates.Gas Prices, SS COLA 2022, Student Loans…

After Oregon lawmakers approved one-time stimulus payments back in March, there is good news for certain low-income workers who will begin receiving the 600 dollar checks as soon as this week.

Each household will receive up to one payment, as the Oregon Department of Revenue informed last Wednesday that around 141.8 million dollars will be distributed to 236,000 qualifying households.

“We know that the wealth gap has only continued to widen since the pandemic,” state Rep. Rachel Prusak said back in March.

“This means rising costs disproportionately impact our lowest wage workers.

“With this legislation we’re reaching the working families and individuals whose hard work is essential and makes up the backbone of our economy.”

Also Check: Check My Stimulus Check History

Who Will Get A California Stimulus Check

Youâre eligible to receive a California stimulus check payment if you:

- Filed a 2020 California income tax return by October 15, 2021

- Reported an adjusted gross income on your 2020 California tax return of $250,000 or less if you filed as a single person or married person filing a separate tax return, or $500,000 or less for anyone else

- Werenât claimed as a dependent on anyone elseâs 2020 tax return

- Were a California resident for at least six months in 2020 and

- Are a California resident on the date your payment is issued.

The California Franchise Tax Board has a handy online tool that lets you check your eligibility and get an estimate of your stimulus payment amount.

You May Like: When Did The First Stimulus Check Go Out

Check If You Qualify For The Golden State Stimulus

To qualify, you must:

- An ITIN filer who made $75,000 or less

You must include your ITIN on your tax return. Your ITIN cannot be pending. Wait to file your tax return until you have your ITIN. You are eligible for the GSS if you file on or before October 15. If you have applied for your ITIN but have not received it by October 15, 2021, you have until February 15, 2022 to file your 2020 tax return to claim your GSS I.

Also Check: When We Getting Stimulus Checks

What If The Amount Changes Or I Don’t Get A Check

The latest Covid relief bill includes direct checks of $600 for eligible adults and $600 per dependent, meaning a family of four could receive $2,400. Individuals who earned less than $75,000 and those married filing jointly who earned less than $150,000 in 2019 are eligible for the full amount.

Those who made more are eligible for reduced stimulus checks. But, the checks phase out completely for individuals that earned $87,000 and couples that made $174,000 in 2019.

Will There Be Another Stimulus Check From The Federal Government

Most people agree that getting another big stimulus check from the federal government is a long shot at this point. Still, some lawmakers keep pushing for another stimulus check to help Americans who are struggling to rebuild thanks to COVID-19 and its economic impact. And with the Delta and Omicron variants out therewould another stimulus check happen for everyone? You never know. Only time will tell, really. A lot of people didnt think wed see a third stimulus check eitherbut it happened.

With the economy and jobs both on the upswing, the need for a stimulus check is way less than its been since the start of the pandemic. Not to mention, a lot of people have been getting extra cash each month from the Child Tax Credit. Add all of that up and its easy to see that there might not be another stimulus check. But if there is one, dont worrywell let you know.

Read Also: When Should I Expect My Stimulus Check

Don’t Miss: Irs 1040 Form For Stimulus Check

Congress Passes Massive Stimulus Package As Virus Rages

What about the tax-filing season? It begins later next month and its a potentially big complication. This is usually a busy time for the IRS, as it gets ready for taxpayers, and some say Congress is asking a lot of the agency to simultaneously implement a new round of payments. Its hardly an ideal time for this to arrive on the doorstep of the service, said Mark Everson, a former IRS Commissioner, now vice chair of alliantgroup.

Not just that. Theres a lot of potential for confusion. The legislation says the payments need to go out by Jan. 15, but what if they dont? What if it takes awhile for people to receive paper checks, for example? Its conceivable that some people will do their taxes before they receive their payment and will instead claim it as a credit on their return only to receive a payment later. It also seems easier and cheaper for most people to just claim the $600 credit when they do their taxes, instead of the government going through the trouble of sending payments to half the country.

A Treasury official says IRS systems could catch those sorts of double payments. And the agency doesnt want to wait until the next filing season to get the money out. The filing season wont open until the end of January so no refunds would go out until mid-February, which is two months away, the official said. The primary reason for doing it now is to get money into the pockets of people who need it as soon as possible.