Citizenship: Does The Irs Consider My Household Mixed

In the $900 billion stimulus package from December, a US citizen and noncitizen spouse were both eligible for a payment as long as they both had Social Security numbers. This has been referred to as a “mixed-status” household when it comes to citizenship. Households with mixed US citizenship were left out of the first check.

The new stimulus bill includes all mixed-status households where just one member has a Social Security number for a third stimulus check. That potentially includes families with citizen children and noncitizen parents.

In the CARES Act from last March, households with a person who wasn’t a US citizen weren’t eligible to receive a stimulus check, even if one spouse and a child were US citizens.

How To Opt Out Of Monthly Child Tax Credit

If you dont want these advance payments, youll have to go through a few steps to opt out. But its pretty simple really. The IRS set up a Child Tax Credit Update Portal for you to opt out and make any changes.

Dont worryeven though the first payment has already gone out, its not too late to opt out of the advance Child Tax Credit payment. Actually, you have the chance to opt out each month. Really! You just have to do it at least three days before the first Thursday of the month.8 So if you want to opt out in September, make sure to opt out by August 30, just to be safe.

Pro tip: If youre married and filing jointly, then both you and your spouse need to opt out of the Child Tax Credit.

Dont Miss: I Still Havent Gotten My First Stimulus Check

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Don’t Miss: How To Get Stimulus Money

Can I Still Get My Stimulus Checks Good News Us Expats

01/16/2023

United States Expats: Did you receive your three COVID-19 stimulus payments from the IRS? If not, you could be eligible to claim up to $3,400, but you need to act soon.

Important context: The stimulus checks relate to the federal governments initiative to offer some financial relief to individuals and families in the wake of the COVID-19 pandemic.

Also known as the Stimulus Payments, Economic Impact Payments, or Recovery Rebate Credits, three legislative initiatives in 2020 and 2021 provided up to $3,400 per individual and up to $2,500 per eligible child. They were:

I Need Help Buying Food

I need help buying food.

There is extra money available for food. Find your states SNAP program.

or call: 221-5689

I have kids.

Start accessing this money by filing your taxes with the IRS.*

You May Like: Non Filers 4th Stimulus Check

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Need To Catch Up On Expat Tax Filing

Are you reading along and getting excited about the prospect of being able to claim potentially thousands of dollars in tax-free payments from the IRS, but worried or confused because youre a little behind on filing? No worries! If youre behind on your tax filing obligations to the US, there is a way to catch up penalty-free and claim any stimulus payments or relevant tax credits for which you might be eligible. This procedure is called the Streamlined Procedure.

Remember, even if you already filed your tax return, you or a certified accountant can still file an amended one.

Contact a Bright!Tax today to discuss how you can maximize your stimulus payment claims and minimize your overall US tax liability. The COVID-19 pandemic will be one recorded as one of the defining challenging periods of our generation, and our team is committed to ensuring that the maximum amount is claimed for each of our expat partners.

Don’t Miss: Where Do I Apply For Stimulus Check

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Can The Government Reduce Or Garnish My Economic Impact Payment

Your Economic Impact Payment will not be subject to most types of federal offset or federal garnishment as a result of defaulted student loans or tax debt. However, the payments are still subject to garnishment if youre behind on child support.

The payments may also still be subject to State or local government garnishment and also to court-ordered garnishments.

You May Like: What About 4th Stimulus Check

Is There Anything I Need To Do To Get A Check

As Voxs Fabiola Cineas and Ella Nilsen explained after Congress passed its previous round of direct payments, most people dont need to do anything to get a stimulus check. If you filed taxes in 2019 or 2020, meet the eligibility requirements, and included your direct deposit information, the payment should show up in your account in the coming weeks.

If your direct deposit information isnt on file with the IRS yet, you can still provide those details using IRSs Get My Payment tool before the latest wave of payments starts going out.

Millions rely on Voxs journalism to understand the coronavirus crisis. We believe it pays off for all of us, as a society and a democracy, when our neighbors and fellow citizens can access clear, concise information on the pandemic. But our distinctive explanatory journalism is expensive. Support from our readers helps us keep it free for everyone. If you have already made a financial contribution to Vox, thank you. If not, please consider making a contribution today from as little as $3.

Nursing Homes And Assisted

Since the payment doesnt qualify as a resource for Medicaid purposes until 12 months after it was first received, nursing homes and assisted living facilities should not require residents to sign over their payment until this period has passed. If you believe a nursing home or assisted living facility has improperly taken the payment from you or a loved one, file a complaint with your states attorney general.

You May Like: Do I Have To Claim Stimulus Check On 2021 Taxes

Who Would Be Eligible For The Third Stimulus Check

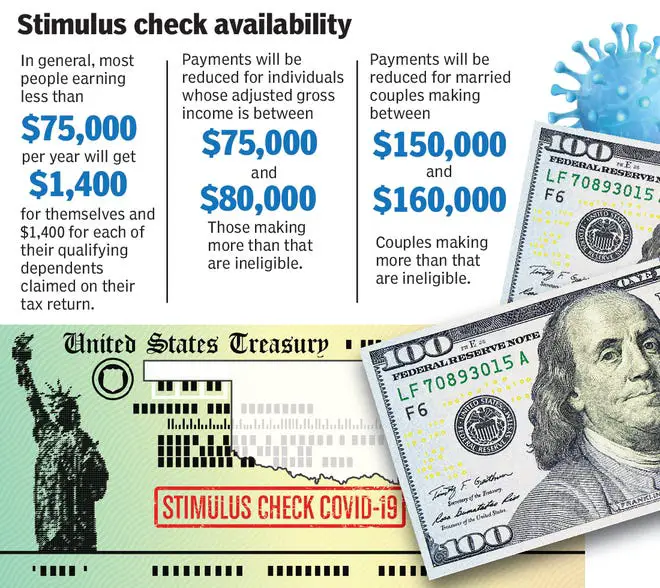

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

Social Security Cash Up To $1800 To Land In Millions Of Bank Accounts In Days

The proposal came after it was heard from many seniors who shared their hardships in the aftermath of the pandemic.

Shannon Benton with the Senior Citizens League told The Sun: âWe have received hundreds of emails from people concerned about making ends meet.

âThe high cost of living adjustment, for many, just exacerbated their financial woes by bumping their income above program limits to qualify for medicare savings programs and extra help.â

The Senior Citizens League isnât the only one that is trying to get Congressâs attention.

Also Check: Did I Receive Third Stimulus Check

The American Rescue Plan Congress Third Legislative Initiative

The American Rescue Plan is the last of the three pieces of legislation passed by Congress to provide non-taxable, direct payments to American citizens and resident aliens in the wake of the COVID-19 pandemic.

Enacted in March 2021, the American Rescue Plan provides payment of up to $1,400 for eligible individuals. If you are married and filing jointly, the total amount you can get goes up to $2,800.

And with the American Rescue Plan, you can receive $1,400 for every qualifying dependent, including adult dependents. Its not limited to qualifying children like the CARES and Tax Relief Act.

The American Rescue Plan has one notable difference compared to the other two initiatives. Its claimable on the 2021 tax return, not on the 2020 tax return.

Third Stimulus Check Eligibility For Dependents

Unlike the previous stimulus checks, this round of payments offers expanded eligibility for dependents. That means more people qualify for payments than before. Those people qualify for larger checks, too.

Dependents are eligible for the full third stimulus check amount of $1,400. In order to be eligible, the dependent must be 17 or younger, or a college student. The dependent can also be an older adult that relies on their child or other legal guardian. Children with certain disabilities of all ages are eligible, too.

If you’re still missing what you believe you were owed from the first or second stimulus checks, be sure to claim a rebate on your 2020 tax return. Use the Recovery Rebate Credit on line 30 of your 2020 Form 1040 or Form 1040-SR. You can also call the stimulus check IRS phone number for more guidance.

You May Like: How Do I Get My 3rd Stimulus Check

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Americans Who Did Not Previously Qualify For The Third Stimulus Check May Be Able To Claim The Direct Payment In The Tax Return They File This Year

Americans who missed out on a third-stimulus-check payment in 2021 may be able to claim the money in their tax return this year.

Sent out as part of President Bidens $1.9tn American Rescue Plan, which was signed into law in March 2021, the third stimulus check saw eligible US taxpayers receive up to $1,400 each, with households getting an additional $1,400 per dependent.

Same initial income thresholds as previous stimulus checks – but lower phase-out limit

As was also the case with the first and second stimulus checks – which were approved in April and December 2020, respectively – the full amount went to individuals on up to $75,000 a year and joint filers with an annual income under $150,000.

However, fewer higher earners were eligible for a smaller payment: individuals with an annual income over $80,000 and joint filers earning anything above a combined $160,000 a year were left out.

This compares to a final phase-out limit of $99,000/$198,000 in the first round of stimulus checks, and $87,000/$174,000 in the second.

Over 170 million third stimulus checks sent out

As of July 2021, the Internal Revenue Service said it had distributed over 171 third-stimulus-check payments totaling more than $400 billion – and these figures are now likely to rise during tax season in 2022.

You May Like: How To File For Your Stimulus

The Last Of The $1400 Stimulus Checks Will Get Distributed To Eligible Parents This Tax Season

The third round of stimulus checks went out to more than 169 million U.S. taxpayers last year. The consensus on Capitol Hill remains that the $1,400 stimulus checksthe largest payment of the three roundswill be the last of the COVID-19 direct payments.

That said, the IRS hasnt finished sending out that third round: Another $1,400 stimulus checks will go out to eligible parents and guardians of 2021 newborns once the 2021 tax returns are filed this year. Thats because when the IRS sent out the $1,400 checks last year, it used taxpayers last tax return on filewhich, of course, wouldnt have included any children born in 2021. Thats why the check will get applied to parents and guardians 2021 tax returns, according to reporting by Fortune and Insider.

But having a 2021 newborn alone wont score parents and guardians that additional check. They will also need to meet the income eligibility requirements. To get the payment, single filers would need to make no more than $75,000 per year in adjusted gross income, while couples filing jointly would need to stay below $150,000. Parents earning above those levels would see their checks reducedand be completely phased out if theyre a single filer earning above $80,000 or a couple filing jointly earning above $160,000.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Read Also: Check On Status Of Stimulus Check

You Might Get A Fourth Stimulus Check

You Might Get a Fourth Stimulus Check

Were reader-supported and only partner with brands we trust. When you buy through links on our site we may receive a small commission at no extra cost to you.Learn More. Product prices and availability are accurate as of the date and time indicated and are subject to change.

Are we getting another stimulus check? If you live in certain states, the answer is yes. Its no secret that gas, grocery, and housing costs are skyrocketing rapidly. As we look for financial relief, some states are giving taxpayers a fourth stimulus.

Keep in mind that each state isnt receiving a federal stimulus. It could be a tax rebate, dividend, or stimulus check, varying from state to state.

Some states have already sent out checks, and some are coming in October through January 2023. Taxpayers can get up to $1,050.

Is your state giving you some cash relief? Check our list and find out if youll get a 2022 stimulus check.

And if youre looking for ways to get more cash in your pocket, download the KCL app and keep tabs on our food recalls and list of class-action settlements.

Recommended Reading: Senior Citizens Stimulus Check 2021

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Don’t Miss: Can I Still File For My Stimulus Check